Subscription payments: The importance of automating recurring transactions

Payments are very important to your business, but it’s also something you don’t want to spend a lot of time on. It just needs to work. In this post, we’ll share a few tips on how to optimise and automate your recurring payments. Both to make sure you get your money on time, but also to make them fast and easy for you as well as for your customers.

Find the right billing period

For consumers, monthly payments are often preferred. Weekly payments are too much of a hassle, whereas yearly payments can present too big of a commitment or simply be too big of an expense at once. With monthly billing, you’ll also allow for a certain level of flexibility, and that’s something consumers like.

If your customers, on the other hand, are businesses, yearly payments can be the right way to go. They often need your service on a long term basis, and yearly payments will save them from extra accounting work. A good idea could be offering a discount on yearly subscriptions (as compared to monthly subscriptions).

Automate your payments

If you sell subscriptions or memberships, your customers will be paying on a recurring basis. You need to automate these recurring transactions to please your customers - they do not want to go to your site to confirm each payment.

For this to happen, you’ll need a payment provider that allows you to store customers’ payment information in order to automatically withdraw the agreed upon amount each week/month/year.

You still have to pay attention to billing and invoices, though. Maybe your customer did an upgrade or downgrade since last payment? Or maybe they bought add-ons? You need to keep track of this so that invoices always match the actual transactions. It’s also worth spending some time on the invoice - make it pretty, transparent, and informative. It is, after all, pretty much the only communication between you and your customers.

One downside of automated payments is that people sometimes forget what they’re paying for. As a result, they’ll think your transaction is fraudulent and they will dispute it. How can you avoid this?

- Send out notifications shortly before a payment is due. By reminding the customer that you’ll withdraw money from their account soon, you reduce the risk of disputes.

- Specify the next billing date in each invoice. It can serve as a reminder and the customer will be able to look it up if they’re in doubt.

- Write a good descriptor. A descriptor is the short piece of text that represents your transaction on customers’ account statements. Make it as precise as possible. If you choose the name of your company, your product, or your website, the customer will have no doubt where the transaction is coming from.

What to do about invalid and expired cards?

A customer might forget to update their card information in case their card expires, gets stolen, or gets lost. That is, of course, very unfortunate, but there are a few things you can do to make sure you get your payments on time.

First, you can do low-amount authorisations on all customers’ cards shortly before the billing date. You won’t actually withdraw any money from their account, you’ll simply be checking that the card is still valid. If it’s not, you have some time to contact the customer and ask them to update their payment information.

Secondly, you can look into using other payment methods, for example, a mobile wallet. People are much more likely to update their payment information in a wallet since they use it for several purposes. However, not all mobile wallets support recurring payments (yet) - but there might be one used by your target audience?

What to do about insufficient funds on customers’ cards?

You can also run into the issue of insufficient funds, simply that the customer does not have enough money on their account to cover the purchase. It’s especially a typical issue on debit cards.

The most popular solution to this is timing the billing date with payday - cause that’s when most people have the most money in their account. Alternatively, you can let customers choose when to get billed. Maybe they are paid biweekly, and all other bills are due on the 1st of each month. Then it’s better if they can pay you in the middle of the month.

Again, sending out a pre-billing notification can be helpful. If a customer does not have enough funds in their account, they’ll have time to transfer some from another one.

You should set up a system that notifies you whenever an authorisation fails. You can also schedule when you want to try again, for example, one hour or one day after the initial payment was rejected. Just to check if the customer got more funds in their account in the meantime. There’s also the chance that the rejection was due to an error in the system - another reason that trying a second time is always a good idea.

Use your data to optimise payments

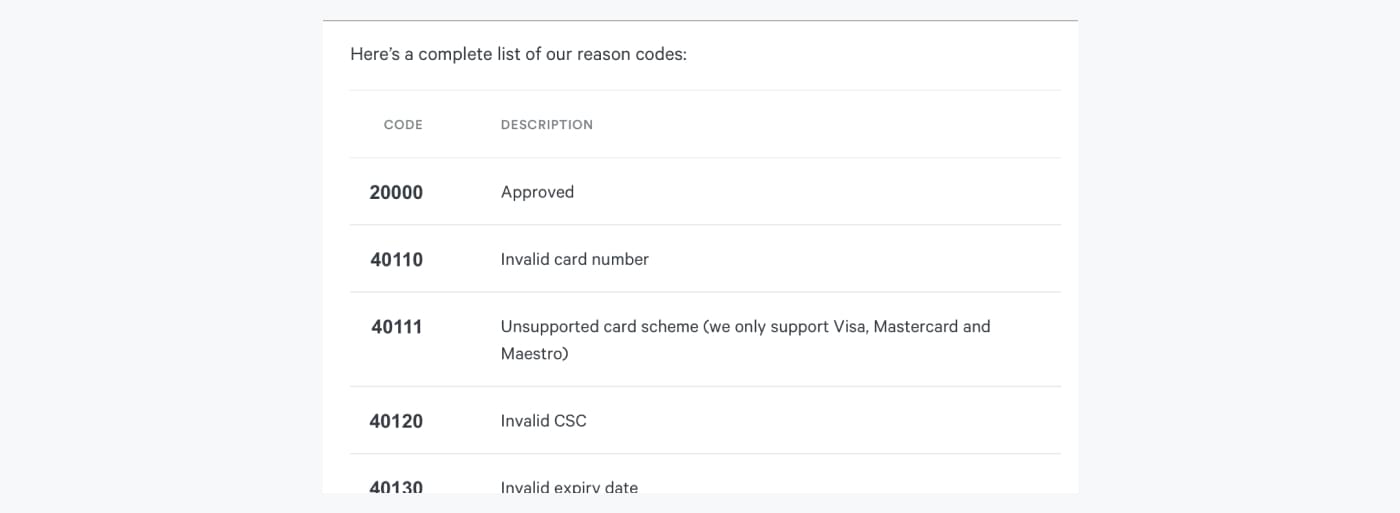

Whenever a transaction is rejected, you’ll receive a reason code explaining why it didn’t go through as planned. Below, you can see some of the possible reason codes. You can find a complete list here.

You should use this data to analyse your failed transactions. Maybe there’s something you can do to avoid these rejections in the future?

It’s also a good idea to look into the timing of your failed transactions. Are more transactions rejected on a specific date or time of day? For example, financial institutions typically do maintenance on their systems during the night or early morning. This can cause failures in their system, so maybe you want to avoid doing authorisations at this time. Whatever information your data can provide can help you do better in the future.

As a Clearhaus customer, you will always have access to free customer support if you run into these kinds of issues.

What to look for in a payment provider

By now, most payment providers support automated recurring payments but that doesn’t mean that all payment providers can offer you the same level of service when it comes to handling subscriptions. Here are a few things you can look out for.

- Make sure that BOTH your gateway and acquirer do in fact offer automated recurring payments. That’s an absolute necessity.

- Go for an acquirer that supports dynamic descriptors. It will let you choose your own descriptor and in case you have more than one shop, you’ll be able to have a descriptor for each.

- Choose a payment service provider that specialises in subscriptions or offers a special selection of subscription features such as upgrades, paused subscriptions, cancellations, or dashboards.

Will PSD2 affect subscription payments?

By September 2019, EU’s Payments Service Directive 2’s final mandate will come into effect and Strong Customer Authentication (SCA) will be required for most EU transactions above 30 euros. Strong Customer Authentication requires that at least two factors must be provided in order to confirm that the customer is the rightful owner of the card being used. The factors can be either a static password, a one-time password, or a biometrical feature. This could, potentially, present some challenges to automated payments.

However, PSD2 does offer some exceptions to the SCA requirement, one being that recurring transactions of the same amount will not need SCA. This means that if your customers pay the same exact amount each week/month/year, you will be able to automate the payments.

If, on the other hand, your customers do not pay the same amount, you might potentially run into problems. Your customers will then have to provide the 2 authentication factors for each transaction, forcing them to approve each transaction on your website. As you can see, this makes things a lot more complex and time-consuming.

Luckily, the card schemes have realised that this will cause some troubles. Therefore, they’ve come up with some possible solutions. Here’s what Visa has done (Mastercard offers similar solutions):

- Introduced Visa Transaction Advisor, helping online shops assessing the risk of a transaction before authentication. Low-risk transactions are another exemption to the SCA requirement, so if online shops are able to qualify their transactions as low risk, the customers will not have to provide the 2 factors.

- Introduced Visa Trusted Listing, a programme that lets consumers whitelist certain trusted online shops. When a company is on this list, the customer will not have to provide the 2-factor authentication procedure. A business must be registered in this programme by their acquirer in order to be eligible to get on consumers’ lists.

This is more or less what you need to do in order to optimise your recurring payments. It’s worth looking into, as it can save yourself and your customers for a lot of time and troubles.