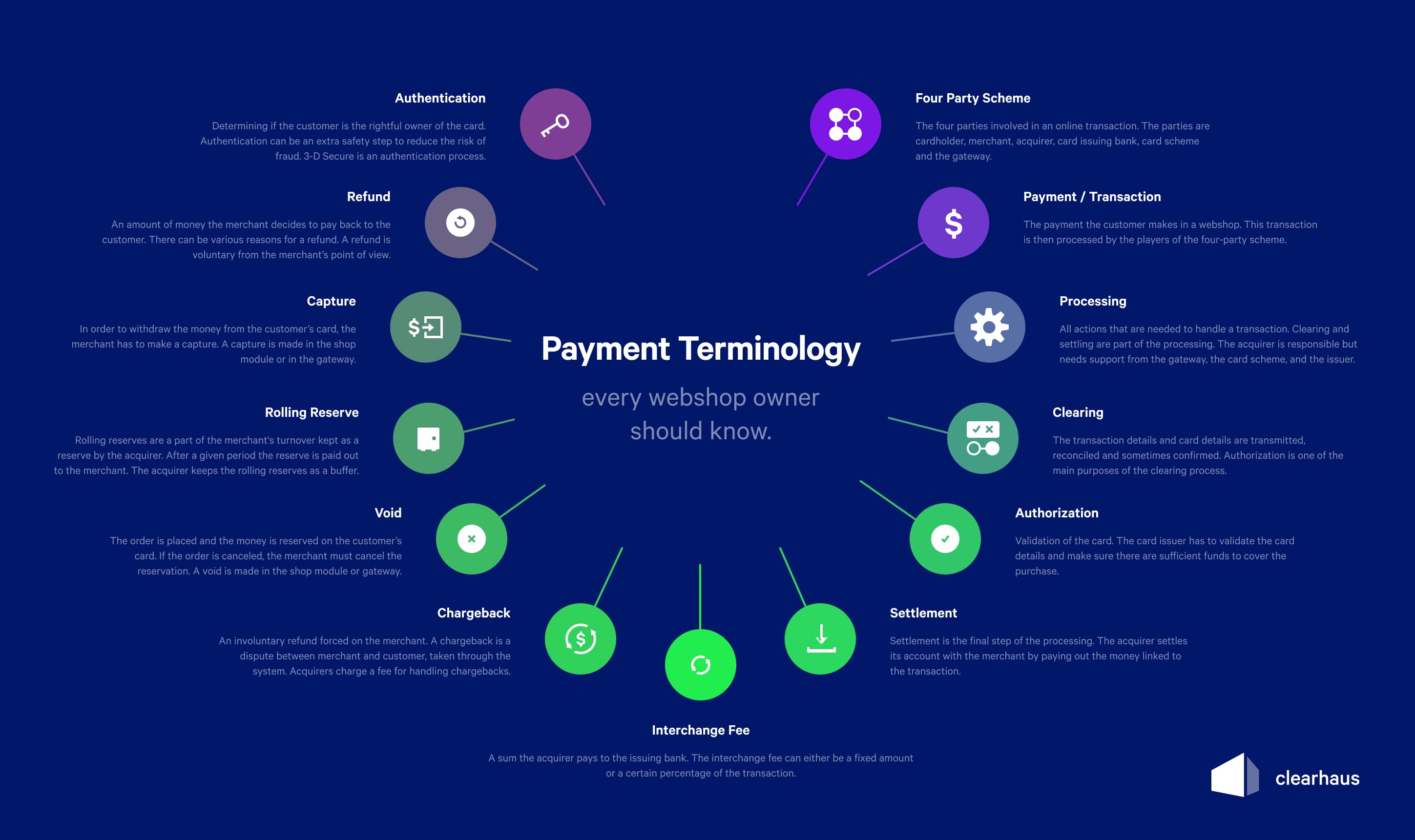

Dictionary: Payment terms you should know

Dealing with online payments can be quite confusing, especially if you’re new to e-commerce or in the early stages of setting up your webshop. You will encounter some very specific terms that you will need to know in order to manage your payments and interact with customers.

Well, we thought it was time to create a blog post that could serve as a holistic payment terms glossary - one that not only defines each term but also offers some helpful resources in case you want to learn about them in more depth. We hope you can bookmark this post and come back to it whenever you need to.

Four-Party Scheme

A term describing the parties involved in an online transaction. In reality, there are six parties that work together to make a payment happen. The four main parties are cardholder, merchant, acquirer, and card issuer, however, the card scheme (e.g. Visa and Mastercard) and the gateway also play a crucial role. Click here to learn more about the four-party scheme and its parties.

Payment/Transaction

The term denotes the payment the customer/cardholder makes in a webshop. This transaction is then processed by the players of the four-party scheme. The terms “payment” and “transaction” are used interchangeably in the industry.

Processing

This term covers all the actions that are necessary in order to handle a transaction, from when it enters the system until it leaves it. Clearing and settling are part of the processing. The acquirer is responsible for the processing of a payment but needs support from the gateway, the card scheme, and the issuer to complete it.

Clearing

In the clearing process, the transaction details and card details are transmitted, reconciled and sometimes confirmed. The gateway records the card and transaction details in the merchant’s webshop and transfers them to the acquirer. This information then goes through the card scheme to the issuer. The money related to the purchase is transferred from the issuer to the acquirer.

One of the main purposes of the clearing process is the authorisation of the purchase.

Authorisation

The acquirer will contact the card issuer in order to authorise the transaction. This basically means to validate the card. The card issuer (the cardholder’s bank) has to validate the card details and make sure there are sufficient funds to cover the purchase.

Settlement

The settlement is the final process of the processing. The acquirer settles its account with the merchant by paying out the money linked to the transaction. The money is now with the final and rightful owner and the transaction leaves the processing system.

Authentication

This term deals with determining whether the cardholder is in fact who he claims to be. That is, is the person making the purchase the rightful owner of the card? Authentication is not always done when processing a transaction but it is seen more and more often. Authentication can be added as an additional safety step in order to reduce the risk of fraud. 3-D Secure is an example of an authentication process, read more about it here.

Refund

A refund is an amount of money that the merchant decides to pay back to the customer. There can be various reasons for a refund, e.g. the customer returns the product, the customer makes a complaint about a faulty product etc. The refund is voluntary from the merchant’s point of view.

Chargeback

A chargeback is an involuntary refund forced on the merchant. If the customer makes a complaint or demands a refund, but the merchant does not agree to this, the dispute can be taken further through the system. As a result, the merchant may be forced to pay a refund to the customer. Because the acquirer has been involved in handling the dispute, they charge a fee. The fee covers card schemes fees, administrative costs, fees to the issuing bank and time spent solving the dispute. Therefore, a chargeback is more expensive than a voluntary refund. Chargebacks often occur as a result of misuse of the card, that is, as a result of a fraudulent transaction.

Capture

When a purchase is made in a webshop, the money gets reserved on the customer’s card if the authorisation clears. In order to actually withdraw the money from the customer’s card, the merchant has to make a capture. A capture represents the transfer of the money from the customer’s card to the merchant account. A capture is made in the shop module or in the gateway.

What is important to remember is that the merchant is not allowed to capture the money before he ships the order in case of physically delivered products.

Void

A void is basically the opposite of a capture. The order is placed and the money is reserved on the customer’s card. However, if the order is canceled for some reason, the merchant will also have to cancel the reservation on the customer’s card. The purchase is canceled after the authorisation but before the settlement. A void is made in the shop module or gateway.

Rolling reserve

Rolling reserves represent a part of the merchant’s turnover that is kept as a reserve by some acquirers. Rolling reserves are kept for a certain period of time. After the given period the reserve is paid out to the merchant. The acquirer keeps the rolling reserves as a buffer. In case the merchant’s account goes negative (due to chargebacks) the acquirer can pay the deficit with the reserves and limit their losses on the given customer.

At Clearhaus the rolling reserves are kept for 80 days and amount to 5% of the turnover.

Interchange fee

An interchange fee is a sum the acquirer pays to the issuing bank - and is therefore outside of the control of both card scheme and acquirer. The interchange fee can either be a fixed amount or a certain percentage of the transaction.