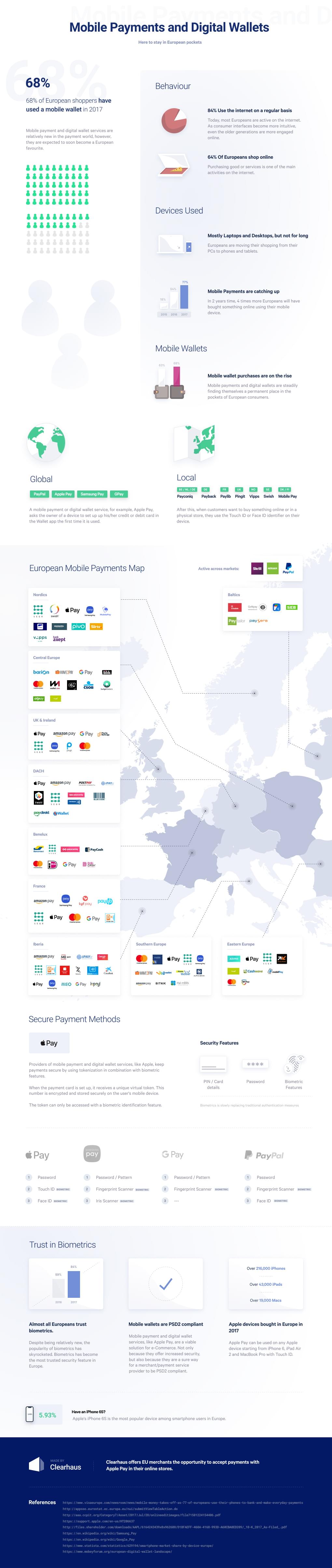

[Infographic] Mobile Payments and Digital Wallets in Europe

Did you know that a growing number of Europeans prefer to purchase goods and services online rather than in physical stores? Why is that? Is it because Europeans are more internet-savvy? Is it because mobile devices are a faster and friendlier way to shop, especially online? Most likely!

It’s a fact that the world of payments is changing at a rapid pace, particularly in Europe. Modern consumers tend to leave their wallets at home when they go out shopping. They are replacing their physical bills and cards with mobile payment and digital wallet services as a means of payment. The same happens when shopping online. This infographic summarises interesting facts about how Europeans shop, with a focus on the use of mobile payment and digital wallet services.

Mobile payment and digital wallet services have come to stay in European pockets. In fact, 68% of European shoppers have used a mobile payment and digital wallet service in 2017. Though mobile payment and digital wallet services are relatively new in the payment world they are expected to soon become a European favourite. 84% of the Europeans are active users of the internet. As consumer interfaces become more intuitive, even the older generations are more engaged online. 64% shop online, which makes purchasing goods or services one of the main activities on the internet. Laptops and desktops are currently the main devices used in online shopping, but not for long. Europeans are moving their shopping from their PCs to phones and tablets. In 2 years time, 4 times more Europeans will have bought something online using their mobile device.

Mobile Payments and Digital Wallets

A mobile payment or digital wallet service, for example, Apple Pay, ask the owner of a device to set up up his/her credit or debit card in the Wallet app the first time it is used. After this, when customers want to buy something online or in a physical store, they use the Touch ID or Face ID identifier on their device.

Security features & Biometrics

Providers of mobile payment and digital wallet services like Apple keep payments secure by using tokenisation in combination with biometric features. When the payment card is set up, it receives a unique virtual token. This number is encrypted and stored securely on the user’s mobile device. The token can only be accessed with a biometric identification feature.

Almost all Europeans trust biometrics and as a result, biometrics is slowly replacing traditional authentication measures. Despite being relatively new, the popularity of biometrics has skyrocketed. Biometrics has become the most trusted security feature in Europe.

Mobile payment and digital wallet services like Apple Pay are a viable solution for e-Commerce not only because they offer increased security, but also because they are a sure way for a merchant/payment service provider to be PSD2 compliant.

Apple Devices in Europe

Apple is a popular brand in Europe. In 2017, European consumers bought over 216,000 iPhones, 43,000 iPads and 19,000 Macs. In fact, Apple’s iPhone 6S is the most popular device among smartphone users in Europe. Apple Pay can be used on any Apple device starting from iPhone 6, iPad Air 2 and MacBook Pro with Touch ID.

Clearhaus offers European merchants the opportunity to accept payments with Apple Pay in their online shops.