How to choose the right payment gateway

A gateway is just one piece of the puzzle of payments in e-Commerce. Choosing the right gateway for your webshop can save you time and money if you know what to look for. Ready? Here we go!

What is a gateway?

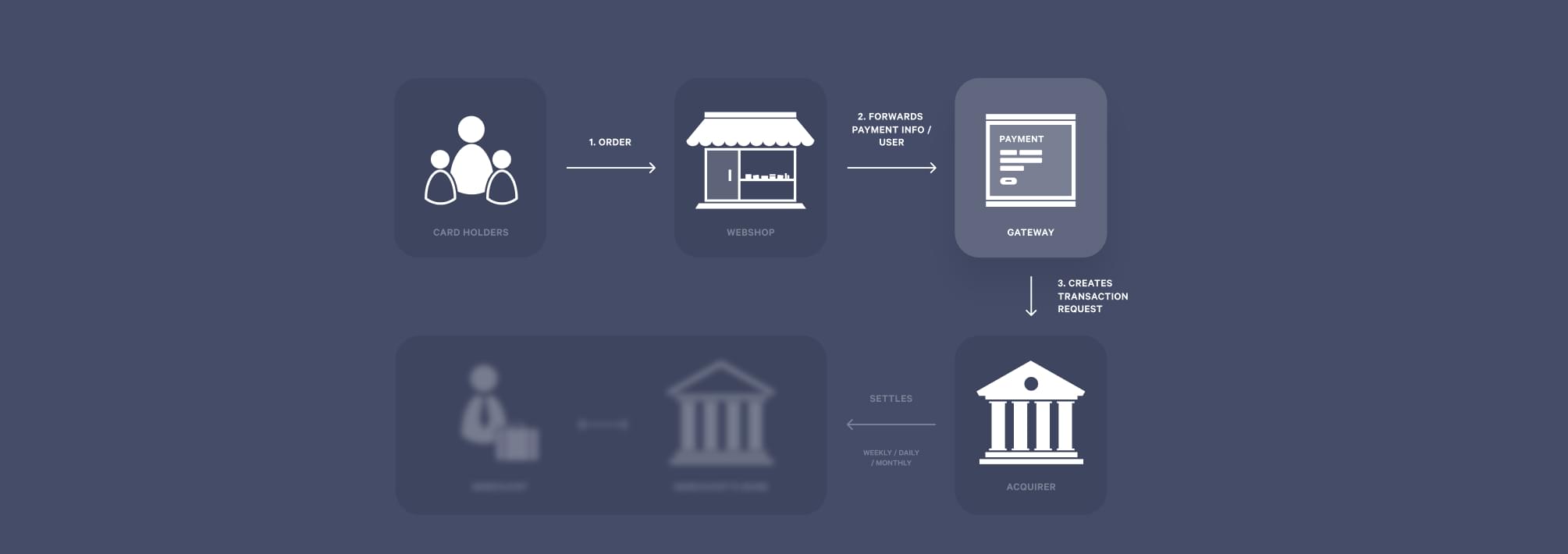

Let’s start with the beginning. Taken from our blog post on the four-party scheme, a gateway is a company that:

- offers a solution for you (the merchant) to accept the card information used by your customers (the cardholders) to make purchases in your webshop, as well as administer payments

- provides the payment window/form in your webshop. This window is where the cardholder types in his card information when he reaches check-out

- handles the card information and forwards it in an encrypted version to the acquirer

How to choose a gateway?

Now that we’ve clarified what a gateway is, let’s find out how to choose one.

Remember though, some businesses opt to have several gateways for their transactions. This is because one gateway may serve a business for one purpose:

- gateway 1 offers a low fee per transaction etc.

while another gateway for another purpose:

- gateway 2 has modern tools for fraud prevention etc.

In order to make an informed decision, we recommend you evaluate your list of gateways based on the subjects below.

1. Applying

If you want to work with a gateway, you need to sign up/apply for an account.

Before applying, remember to:

- Look at how long does the application process take (some gateways may even offer instant sign up)

- Ask when will you be able to start accepting payments

- Read the contract terms, especially the length of the contract. Some gateways offer minimum-time contracts, for example, a contract which has to last for at least 1 year etc. If this is the case, be sure to check for any fees if you want to terminate the contract before the minimum time specified.

2. Locations and currencies

The sections below go together, so it’s essential that the gateway you’re thinking of fulfills both points.

Take into account the location of your company and your target area.

- Make sure that the gateway you are considering supports the country in which your company is registered. Plus, check that the gateway supports the countries in which you want to offer your products/services.

Make a note of the currencies you will accept payments in. Are you thinking of euros and USD, or euros and British pounds?

- Depending on your list of currencies, be sure that the gateway supports your entire list

Picking out a gateway becomes difficult when the offer is not clear enough.

Example

You’re a Swedish merchant looking to sell your products/services in exchange for Swedish kroner, Danish kroner, and euros. You want to sell your products/services in Sweden, Denmark, and Italy.

It is possible to stumble upon a gateway which supports euros overall but does not support a specific euro-using country, i.e. Italy. This poses a problem because you want to do business in Italy. In this scenario, the gateway isn’t a good one to use.

3. The cards and payment technologies accepted

Since you want to accept payments via card or payment technologies, ask the potential gateway about what card types, card schemes, and payment technologies (methods) does it support.

Card types

- Credit card

- Debit card

Card schemes

- Mastercard

- Visa

- JCB

- American Express

- Dankort (Denmark)

- Discover card

- Other

Payment methods

- MobilePay (Denmark)

- Apple Pay

- Samsung Pay

- Other

4. The Fees

Always let the gateway know you are curious about the costs connected with the contract. Preferably, the payment gateway will have a transparent pricing list.

Pay attention to the following fees associated with:

- Applying

- Setup

- Monthly activity

- Transactions

- i.e. transactions performed with locally/foreign issued business/consumer cards

- Refunds

- Payouts

- Currency conversions

- Business model (e.g. high-risk, enterprise etc.)

- Disputes/chargebacks

- Transaction limits

- Termination

- Features

Gateways usually take a percentage out of each transaction, for example, 1.9%. However, the payment type (e.g. made with a business card etc.) can alter the interest charged by the gateway.

5. Tools/Features for fraud prevention

The basic prevention tool used by gateways is the Card Verification Value (CVV). It is strongly recommended in e-Commerce that merchants look for gateways which offer more developed fraud prevention tools like 3-D Secure due to the application of PSD2..

6. Customer support

Depending on the extent of your collaboration, search for a gateway which has:

- Customer support via channels like phone, e-mail etc.

- International customer support, mainly if the gateway is foreign

7. Security

Don’t forget to think about how secure the gateway is. When searching for one, consider gateways which are PCI compliant or offer features such as tokenization.

8. Recurring and Subscription-based transactions

If your business model uses recurring/subscription-based transactions, remember to select a gateway which can support them through a:

- Well-developed API

- Plug-in

9. Customizing your payment window/form

A great deal of cart abandonment/lost conversions in e-Commerce takes place during the phase when customers have to put in their payment information.

Customers most often drop their purchases because they are greeted by either an unfamiliar payment window/form, or one that is not user-friendly. As a result, go for a gateway which provides:

- A pleasant-looking payment window/form

- The ability to customise/design the payment window/form yourself

- The opportunity to embed the payment window/form into your website

Keep in mind that some payment windows/forms that can be customised may have problems with using 3-D Secure. Make sure that you find a gateway which fully supports the security feature in its customizable windows/forms.

10. Integration

Keep in mind integration. You would like to select a gateway that has an extensive API, which can be used to seamlessly integrate with several software solutions you may be using, such as:

- Accounting

- Billing

- Shopping cart

or very important, which integrates with your acquirer.

List of gateways

Ok, now that we’ve covered all the areas that you should pay attention to, it is time to start considering your options. If you don’t have any specific names in mind, here’s a list of gateways supported by Clearhaus.

Next step

After you have chosen a gateway, it is time to take the next step- selecting an acquirer. Don’t know exactly what an acquirer is and why you should have one? Read our article “How to choose the right acquirer”.

Conclusion

Your gateway will play an important role in the way your online business runs. To make the process of choosing a gateway (or several ones) easier, keep in mind to ask about or check the following sections:

- Applying

- Locations and currencies

- The cards and payment methods accepted

- The Fees

- Tools/Features for fraud prevention

- Customer support

- Security

- Recurring and Subscription-based transactions

- Customizing the payment window/form

- Integration

After selecting the gateway(s) that fits your business best, you can concentrate on increasing your sales and expanding your reach.

Also, in case you don’t have one or are considering working with something different, you can start considering looking for an acquirer.