How to choose the right acquirer

Whether you’re new to the game or just want a change of scenery, selecting an acquirer can be made easier if you know what to look for, what to ask, and what to answer. After all, it’s an important business move, and you want to get the most out of it, right? Our thoughts exactly.

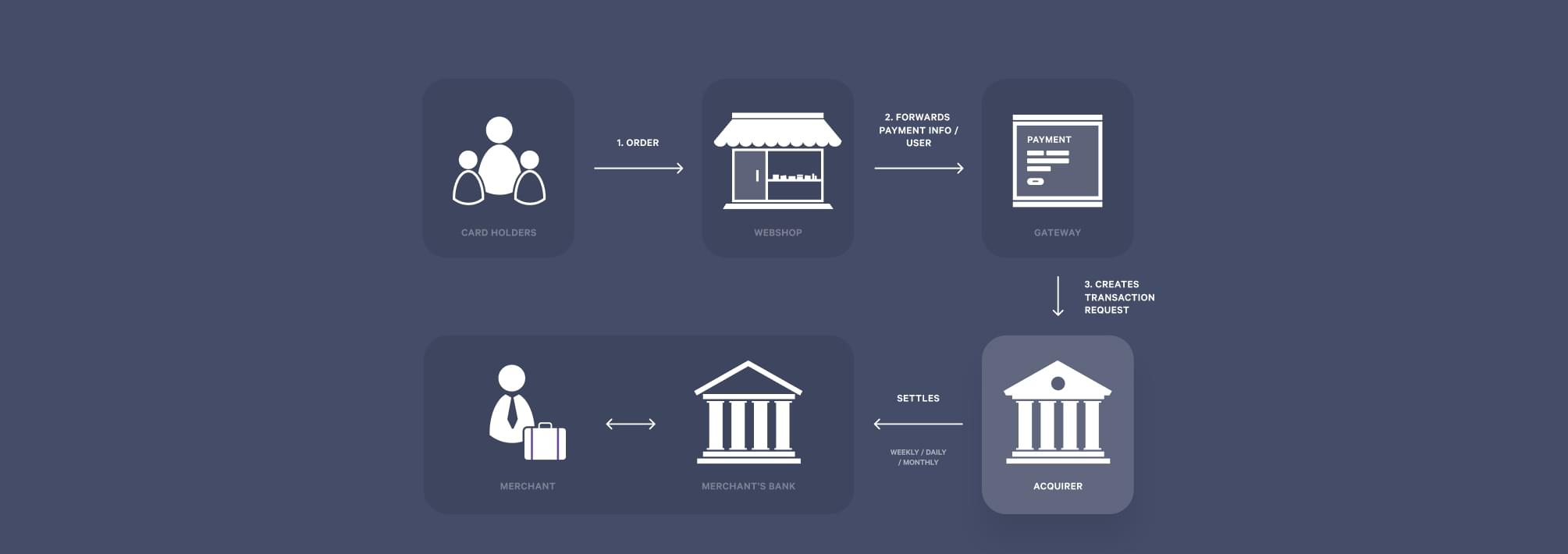

What is an acquirer?

The acquirer is a financial institution that handles the transactions between your webshop (merchant) and your customers (referred to as “cardholders” from now on). When the acquirer receives the card information from the gateway for a purchase made on a webshop, it will perform:

Authorisation - checking with the issuer (bank where the cardholder has his account open) if the card is valid and if there are sufficient funds for the purchase

Authentication (optional) - testing the identity of the person making a payment. At checkout, after typing in the card details for a purchase, the person is asked in a pop-up window or inline frame to verify the identity of the cardholder. Authentication is usually performed using 3-D Secure.

If both authorisation and authentication are completed successfully, the acquirer will, after being given the instruction to do so by the issuer and being notified that the goods have been sent by the merchant, do the following:

- withdraw the sum from the cardholder’s account (capture/collect the money)

- place the funds in the webshop’s merchant account (similar to a bank account) for a limited time (hold the money)

- transfer the funds from the merchant account to the bank account of the webshop (settle the money)

Why do I need an acquirer?

This question comes up rather frequently. The answer is quite simple. In order to accept online payments for your goods or services as a company, you have to sign up for a merchant account with an acquirer.

Why can’t I just use my own bank account?

You could, in principle, if your issuing bank offered acquiring services. Sometimes, issuing/sponsoring banks (banks where companies have their settlement accounts) offer acquiring services, but more often than not, they charge high fees and ask for long-term commitments. There are, however, cost-effective, external financial alternatives - separate acquirers.

Besides selecting an acquirer, you often need to choose a payment gateway as well. Sometimes, even before looking for an acquirer.

The gateway provides the payment window in your webshop. This window is where the cardholder types in his card information when he reaches checkout. How to choose a payment gateway? Well, we have the post “How to choose the right gateway” for that.

Now, let’s go back to choosing an acquirer.

What to look for in an acquirer?

There is no “one size fits all” when it comes to selecting an acquirer. Your choice depends on how well an acquirer supports your business.

Before rushing into anything, we recommend you to take a look at the facts below to see which acquirer can serve you best:

The types of payment cards you are willing to accept (for example, some acquirers do not support the Discover card)

The average number of transactions expected weekly or monthly in your webshop (this is specifically important due to some acquirers asking for a monthly fee which can be a costly burden on a merchant that has a low number of transactions in its early stages)

The average amount per transaction made in your webshop (this number can help you calculate how much will potential acquirers charge you for each transaction)

After reviewing your business, the quest for an acquirer can start. The best tools to use when considering acquirers are questions.

Here’s a list of things you should ask a potential acquirer.

What should I ask a potential acquirer?

1. Do you work with the payment gateway I’m using?

The answer to this question can have different implications:

- If the acquirer works with your chosen gateway, then you’re all set

- If the acquirer doesn’t work with your chosen gateway, you can:

- look for another gateway

- choose an acquirer that your gateway has integrations with

2. What cards and payment methods do you support?

Since you are interested in offering your customers the possibility to pay for their purchases with payment cards or technologies that use card information, it is of major importance that you ask what card types, card schemes, and payment methods the acquirer supports.

Card types

- Credit card

- Debit card

Card schemes

- Visa

- Mastercard

- American Express

- JCB

- Discover card

- Dankort (Denmark)

- Other

Payment methods

- Apple Pay

- MobilePay (Denmark)

- Samsung Pay

- Other

3. What locations and currencies do you support?

The points below go hand in hand, so it is of utmost importance that the acquirer you’re considering checks all of them.

Be sure to check that the acquirer you are looking at supports (offers its services in) the country in which you have your company registered. Also, check that the acquirer supports the countries in which you want to sell your products/services.

Consider the currencies you will offer your customers to pay in. Is it going to be just euros and USD, or would you like to offer payments in British pounds as well? No matter what your list of currencies is, make sure that the acquirer you are interested in supports your chosen currencies.

How many bank accounts do you have associated with your business? In what currencies are they? Check that the acquirer offers settlements in the currency of your bank account(s).

Problems in choosing an acquirer arise if the offer from the acquirer is not clear enough.

Example 1

You’re a merchant from the UK, interested in selling your products/services to customers in exchange for British pounds, Danish kroner, and euros. You are interested in offering your products/services in the UK, Denmark, and Germany.

It can happen that you find an acquirer which offers support for British pounds, Danish kroner, and euros in general, but it does not support transactions from a particular euro-using country, such as Germany. This would be to your disadvantage since you are interested in doing business in Germany. Unfortunately, in this scenario, the considered acquirer doesn’t serve your company well enough.

Example 2

You’re a merchant from Denmark, looking to sell your products/services in exchange for Danish kroner, Swedish kronor, and Norwegian kroner. You want to offer your products/services in Denmark, Sweden, and Norway.

You discover an acquirer which supports transactions from all three countries but does not support transactions made in Norwegian kroner. This can be a deal-breaker in choosing the acquirer if you want to offer customers from Norway to pay in Norwegian kroner.

Example 3

You’re a merchant from Norway, interested in selling your products/services to customers in exchange for British pounds, Danish kroner, and euros. You are interested in offering your products/services in the UK, Denmark, and Germany. You find an acquirer which allows your customers to pay you in all 3 of your desired currencies, and supports transactions from the UK, Denmark, and Germany.

The bank account associated with your business (the place where you, in the end, receive the money from your transactions), is in Norwegian kroner. The acquirer does not offer settlements in Norwegian kroner, only in British pounds, Danish kroner, and euros. This means that the acquirer cannot transfer the money from your merchant account to your bank account (make the payout/perform the funding) in Norwegian kroner. As a result, if you choose to use this acquirer, you may lose money when the settlement is performed due to the costs associated with converting British pounds, Danish kroner, or euros to Norwegian kroner.

4. What fees do you ask for?

Always tell the acquirer that you are interested in what costs are associated with the contract. Ideally, the acquirer will be upfront and present to you a transparent list of prices and fees.

Here’s a list of fees to pay attention to

- Sign up/application cost

- Setup fee

- Monthly fee

- Transaction fee

- i.e. Fees for authorisation and capture

- i.e. Fees for transactions made with locally/foreign issued consumer/business cards

- Refund fee

- Payout/Settlement fee

- Currency conversion fee

- Business model (e.g. enterprise, high-risk etc.) fee

- Chargeback/dispute fee

- Transaction limits

- Features’ fees

Acquirers tend to charge a percentage out of each transaction. Usually, this percentage is flat. However, depending on the payment type (e.g. made with a foreign issued card etc.), the acquirer may have different pricing.

5. Do you offer any anti-fraud and special features?

It is strongly recommended in e-Commerce that merchants look for acquirers which offer anti-fraud features such as 3-D Secure, especially due to PSD2.

Also, if you are interested in pulling data related to fees and funding to use it for your accounting, consider acquirers that offer automated account reconciliation.

Example

You, as a merchant, receive an order for a T-shirt of 10.00 euros, but the acquirer will fund you 9.80 euros because you pay 2% in fees. You will need this data (besides the shipping expenses and the costs for producing the T-shirt) for you to do proper accounting/“reconcile” your accounting. If you can access this data via an API, you can automate the account reconciliation i.e. subtract automatically the fees that need to be subtracted so you can see your exact earnings.

If your accounting system already integrates with the acquirer, most likely automated account reconciliation will work with just a few clicks, making accounting easier.

6. What is your level of customer support?

Take into consideration an acquirer which offers:

- Customer support on several channels such as phone, e-mail etc.

- International customer support, especially if the acquirer is not from your country

7. What is your level of security?

Since acquirers process cardholder data and transfer money, they need to be:

- Fully PCI DSS compliant

- Financially regulated by a Financial Supervisory Authority

We recommend that you only search for acquirers which meet the above requirements.

8. When will my funds from transactions be sent to my bank account?

Settlement periods, payouts, or funding cycles all refer to the number of days until you will receive the money for the transactions made by customers. At the end of each settlement period, your acquirer will transfer the money from your merchant account to your own bank account. Check the different types of settlement periods that suit your business model:

- Daily

- Weekly

- Monthly

9. Do you support recurring transactions?

If your business model includes recurring/subscription-based transactions, be sure to choose an acquirer which can support them easily through a well-developed API.

10. Can companies similar to mine recommend you as an acquirer 1?

Sometimes you need a little bit of inspiration or confirmation that the acquirer you’re looking at is reliable. It is a good idea to search for company cases that describe the relationship between the acquirer and the companies that use its services.

Also, consider asking the acquirer upfront for examples of companies with which it works.

You have an idea about which acquirer you’re gonna choose (great!), but you’re not quite done yet. The merchant-acquirer relationship is a two-way street and acquirers take a look at their potential merchants as well. Merchants are required to send in an application for a merchant account, and they will only get an account if they are approved.

What does an acquirer ask for?

Before granting you a merchant account, the acquirer assesses the level of risk linked to your business. It wants to check whether it can lose money when handling the transactions between your business and your cardholders. The way an acquirer does this is by asking you a series of questions, for example, we, at Clearhaus, ask you about:

- Company name, registration number, address

- Information about the top management of your company (director)

- Management credentials (e.g. a photo of the director’s passport, a utility bill etc.)

- Company ownership (e.g. Is your company owned by the director? Or are there several owners with shares higher than 25%?)

- Website details (e.g. status of your website (active), chosen gateway, whether cardholders can easily find “terms and conditions” etc.)

- Business model (e.g. description of your goods/services, whether your business supports recurring transactions if your business is also the one shipping the goods offered i.e. not dropshipping etc.)

- Average transaction amount and monthly turnover in your webshop

- History of transactions, if you have previously worked with an acquirer

- Bank account (at Clearhaus you can accept money from your customers in any currency, and we can pay/settle you in DKK, EUR, SEK, NOK, GBP and USD)

We know, it sounds like a lot, but don’t worry! On average, our merchant account applicants use approx. 10 minutes to fill out the application. Also, if something comes up and you have to take a break, you can resume your application later and even invite a coworker to contribute to it.

Conclusion

Selecting your acquirer is quite an important business move. It can be tricky as well, however, doing your homework can make the process more smooth. To do so, it is key:

To know your business well

- What it wants

- How it performs

Ask the right questions

- Do you work with the payment gateway I’m using?

- What cards and payment methods do you support?

- What locations and currencies do you support?

- What fees do you ask for?

- Do you offer any anti-fraud and special features?

- What is your level of customer support?

- What is your level of security?

- When will my funds from transactions be sent to my bank account?

- Do you support recurring transactions?

- Can companies similar to mine recommend you as an acquirer?

… and have your answers ready for when you’re certain about your decision.