A quick guide to payments in e-Commerce

When a customer completes a payment in an online shop, he sets off a long chain reaction. From the customer, the payment actually passes through four parties before ending up with the online shop. But do you know who these parties are? And do you know how that payment is being processed? Let’s take a closer look.

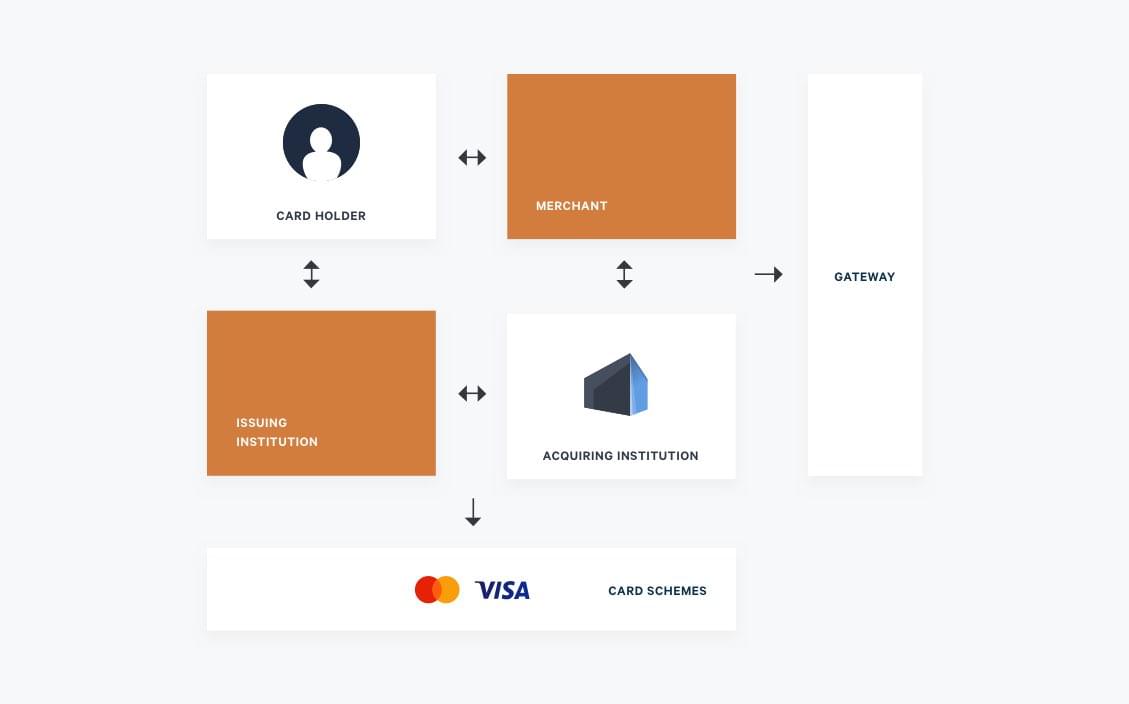

Four Party Scheme

The online payment network is often called the Four Party Scheme (even though there’s typically six parties involved). The Four Party Scheme covers all entities involved in an online transaction. The picture below shows the Four Party Scheme - and we’ve added some arrows to show which parties interact with each other.

The Cardholder

The customer is often called the cardholder. It can be either a private person or a business.

The Online Shop

The online shop is also called the merchant. It’s the selling part and this is where the payment is going to end up after processing. In order to be able to accept card payments, the online shop needs to select both a gateway and an acquirer.

The Gateway

The gateway is in charge of the technical payment setup in the online shop. For example, they provide the payment window in which the cardholder will enter his card details. The gateway also enables different payment methods and security features in the shop.

Their job is to collect payment and card information and forward this (in an encrypted manner) to the acquirer.

Here’s a list of things to consider when selecting your gateway provider.

The Acquirer

The acquirer is in charge of the processing of the payment and they make sure the money is transferred from the cardholder’s bank account to the bank account of the online shop.

When they’ve received the payment information from the gateway, they contact the cardholder’s bank to check that the card is valid and that the associated account has enough money to cover the purchase. This process is called authorisation. If the authorisation is completed, the acquirer will reserve the given amount on the cardholder’s account. When the online shop has shipped off the order, the acquirer will be notified and they will withdraw the money from the cardholder’s account. The acquirer then transfers the money to the online shop’s account in accordance with the payout cycle specified in the agreement.

You should consider these things when choosing your acquirer.

The Card-issuing Bank

The payment card being used has been issued by the card-issuing bank. It is typically the customer’s own bank. The role of the bank is to confirm the validity of the card and make sure that the cardholder’s account holds enough money to cover the purchase. That is, the bank is the acquirer’s counterpart in the authorisation process.

The Card Scheme

A card scheme is the “brand” of the payment card, for example, Visa or Mastercard. The card scheme facilitates the communication between the acquirer and the card-issuing bank. They pair up the card information received by the acquirer with the relevant bank, enabling the acquirer to get the payment authorised.

Why is it called the Four Party Scheme when there are six parties?

The Four Party Scheme puts the spotlight on the four main parties in an online transaction (cardholder, online shop, acquirer, and card-issuing bank) - but it’s important not to forget the two facilitating parties.

The gateway is necessary for the processing of an online transaction and they are typically the ones who are in contact with the online shop. Without their technical setup, the acquirer would not be able to obtain the card information.

The card scheme is equally important since the contact between the acquirer and the card-issuing bank would not be possible without their help.

The term “Four Party Scheme” is used because the four main parties are separate entities, while the gateway and the card scheme are sharing and maintaining the connections between them.

Sometimes one party is integrated with another. For example, some payment providers offer both gateway and acquiring services. Another example is the “old” payment model, where the card-issuing bank would take care of the acquiring part (this is called Third Party Scheme).

To Sum Up

In short, the transaction is split into two parts. First, the card information is sent from the cardholder, through all parties, ending up at the card-issuing bank. If the card information is valid, the payment will be approved and the second part is initiated. Here, the money is transferred in the opposite direction from the card-issuing bank, through the acquirer, and to the online shop. When the online shop has received the payment for the goods or services sold, the payment process is complete.